What the New York casino licensing competition looks like now that MGM has left unexpectedly

There are still three bids for three New York casino licenses, but the twists and turns that have led to this point have only made things more unpredictable.

Casino in New York

This week, MGM Resorts suddenly dropped out of the downstate New York casino process. This was probably the most surprising turn of events in the long-running story so far.

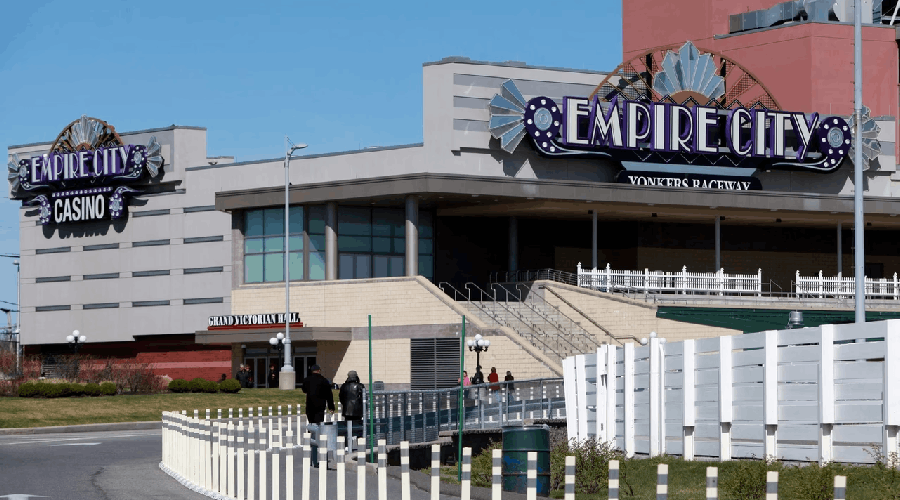

For a long time, people thought the company's $2.3 billion proposal to repair and expand its Empire City racino in Yonkers was the best candidate for one of the three available licenses. MGM said, however, that the project's estimated economic return dropped so much along the process that it was no longer worth continuing.

There are now only three applications left in the running, and all of them sent in new bids to the state this week:

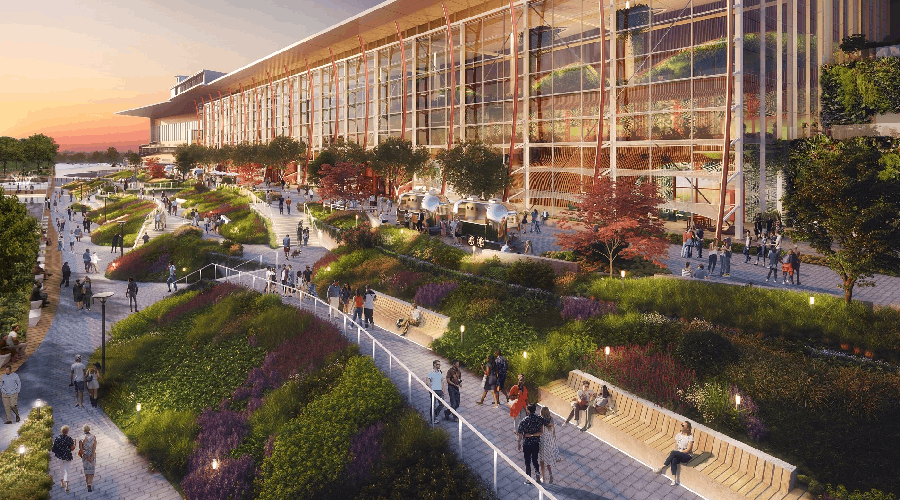

Bally's in the Bronx

Metropolitan Park Resorts World NYC

The estimated cost of building Bally's is $4 billion, followed by $5.5 billion for Resorts World and $8 billion for Metropolitan Park. Resorts World is already a racino, much like MGM, and they want to open their first casino in July 2026. The other two are greenfield projects that would take years to complete and even longer to make money.

Bally's submission doesn't include a date, and Metropolitan Park just says that building will start in January.

The Gaming Facility Location Board (GFLB) for the state is in charge of looking over the other bids based on a number of financial, environmental, and manpower factors. The state has until December 1 to send in its proposals for licenses. By the end of the year, state regulators may decide to give out up to three licenses.

MGM's bid wasn't really good from the start?

MGM's bid was the second-fastest to get to market, with an opening date of July 2027, but it didn't have many other notable features compared to the other bids. The plan did not contain a resort hotel, public parks, or housing obligations, which are all perks that are common in other projects.

There were previously 11 proposals for a casino in New York City, and MGM had the least amount of guaranteed capital investment. It might have been cheaper to put a casino on top of the Saks Fifth Avenue shop in Manhattan, but those involved never gave specific information or made an official offer.

After a first-round deadline in late June, the pool was cut down to eight. Of the eight, MGM was the only bidder that didn't give a presentation to its community advisory committee (CAC) at their first meeting.

Even Nevertheless, the initiative had strong support and was still in the running until it was pulled. The CAC overwhelmingly accepted the bid, and both MGM and municipal officials said that the site needed a commercial licence to stay open.

MGM asserted so in its own application files and sent scores of employees to the CAC to speak in favour of the project. James Cavanaugh, the head of the committee, claimed that the "ageing slot parlour" would "wither and die" without a full licence. For years, Yonkers Mayor Mike Spano pushed for the project. But instead of changing its application and suggesting a bespoke tax rate, MGM just dropped out.

The company noted that the "newly defined competitive landscape" with "four proposals clustered in a small geographic area" made them worry about their investments. It also said that its offer was focused on getting a 30-year commercial casino licence instead of a 15-year one, which is what it qualified for based on how much money it spent.

Days after leaving New York, the sale of Northfield Park was announced.

Two days after the New York announcement, MGM made additional news about its racinos by selling the operations of MGM Northfield Park in Ohio to the private equity firm Clairvest Group for $546 million. In 2019, the same year it bought Empire City, MGM bought the racino's operations for about $275 million.

Bill Hornbuckle, the CEO, said in a statement that Northfield Park is "a great property with great opportunity ahead." But he also said that his company is "focused on growing our digital business, finding new ways to expand internationally, and continuing to invest in our leading integrated resorts in the US."

This looks like more proof that MGM would sell Empire City soon, although the company refuted this in a statement about leaving the New York casino.

The company said, "We know our decision will affect many people. We are still committed to running the property as it is now, and we believe it will continue to be successful serving customers in Yonkers and the surrounding areas."

Several industry sources told iGB that MGM still has time to make a choice, but they did not want to be named. Sources claimed that the downstate licensees wouldn't really start to compete for a few years, but the property should still do well in the meantime.

Empire City made $607.4 million in net win, or hold, in the fiscal year 2025 (April to March). The property is doing a little better than that, making $311.7 million in the first six months of FY26.

Withdrawals show that there are still problems with the NYC casino process.

In 2025, MGM was the third major casino company to drop out of the running on its own, following Wynn Resorts and Las Vegas Sands. The people that left all gave different reasons for their departures, and each of those reasons would still seem to affect any bids that are successful.

In April, Sands was the first to drop out of the race. The main thing it was worried about was "the effect of the possible legalisation of iGaming on the overall market opportunity and project returns." Lawmakers in New York have turned down several attempts to make iGaming legal, but it could become more popular in the future, especially if the downstate licensing procedure is done. Over the next three fiscal years, the state will have a total budget imbalance of $34 billion. It might use iGaming to assist boost tax income.

In May, Wynn was the next person to pull out, saying that the rezoning process was bad for politics. It finally regarded downstate New York as "an area where we, or any casino operator, will face years of constant opposition even though we are willing to hire 5,000 New Yorkers."

Not the only one in political trouble

There has also been political turmoil at both Bally's and Metropolitan Park.

The mayor of New York City, Eric Adams, helped Bally's bid twice in city council. He vetoed one vote and lowered the threshold for another. Steve Cohen, the owner of Metropolitan Park, chose Senator John Liu over local Senator Jessica Ramos when Ramos refused to support its zoning bill.

MGM's worries about competitiveness would still apply to the other applicants. All three are less than 30 miles apart.

After the Tuesday bid deadline, Bally's told iGB it was "ready and willing to bet on the Bronx." Resorts World said its proposal was "a promise kept to the people of New York." Hard Rock International, which is working with Metropolitan Park on its casino, did not respond to a request for comment on its bid.

Casino bidders make balance sheets, and lenders think about the risks.

The rest of the applicants don't know how much it will cost to build or when it will be done. From a macroeconomic point of view, increased tariffs, inflation that doesn't go away, and poor employment growth might have a big impact on new construction. Bidders must also be able to pay for or finance these kinds of initiatives, which is not easy for three companies that are already working on a lot of other projects.

People have been sceptical of Bally's leveraged business strategy, but the company said that its recent reverse merger with Intralot gave it "more than $1 billion of cash and available credit facilities ready to commit to the project." Bally's is also working on big projects in Chicago and Las Vegas, in addition to its interest in New York.

Bally's lenders for the Chicago project are pushing back against the company's attempts to change some parts of its $1.9 billion loan term. This could mean that Bally's continual debt manoeuvring is running out of room. Gaming and Leisure Properties (GLPI) has helped the company expand a lot thus far by giving it money. The new version of Bally's proposal for a casino in New York indicated that GLPI had promised to invest $2.5 billion in the project.

Carlo Santarelli, GLPI's senior vice president of business strategy, told iGB that "there are rarely formal negotiations between the parties nor is anything agreed upon" when petitions include such assertions. He added the corporation would wait for the final licensing decision before making any promises.

Santarelli also said that GLPI "would be willing to work with other bidders and was in fact working with other bidders whose projects did not make it this far in the process."

Costs and timelines are likely to go up because of the state of the economy.

This year, Genting Berhad, the parent firm of Resorts World, has also been quite aggressive in changing its balance sheet. It sold its Resorts World Catskills site to Sullivan County in a complicated deal, and it is currently working on a $6.8 billion development of its main resort, Resorts World Sentosa, in Singapore. The larger Genting wants to buy its Genting Malaysia affiliate for $1.6 billion to help these growth aspirations go more smoothly.

Metropolitan Park is perhaps the safest choice financially, even though it costs a lot of money. Steve Cohen, the owner, is the 100th richest person in the world, with a net worth of $23 billion, according to Forbes.

According to Duane Bouligny, managing director for Wells Fargo Securities, the current forecasts for downstate New York casinos are "aggressive." He noted, "But every lending opportunity is a gamble in and of itself," and banks must trust that operators can follow through.

"We've found that the properties do get there, but it takes longer for their projections to reach those cash flow numbers."

Bouligny stated, "It's not year one, it might not be year two, it might be year four, year five... it takes time to get there." "So, from a balance sheet point of view, we have to believe that they will get there at some point."

He thinks that costs will "go up, not down" because of the state of the economy right now.

Battle of New York casino tax rates and licence fees

Tax rates will be another important factor for the other applicants. The state let bidders make their own offers, with a minimum of 25% for slot revenue and 10% for other gambling.

The GFLB website has information on the three bidders' proposed rates:

Bally's Bronx: 30% for slots and 10% for tables

25% for slots and 10% for tables at Metropolitan Park

56% of the games at Resorts World NYC are slots, while 30% are tables.

The minimum bid for the downstate licence was $500 million, but bidders could pay more. Metropolitan Park offered $500 million, Resorts World offered $600 million, and Bally's didn't say which price they preferred. When MGM said that bidders found out in August, after official bids were due, that the length of the licenses would also rely on financial commitments.

The structure is:

If you invest less than $1.5 billion, you get a 10-year initial licence.

A 15-year first licence is given for investments between $1.5 billion and $5 billion.

You need a 20-year initial licence to invest between $5 billion and $10 billion.

A 30-year initial licence is given to investments of more than $10 billion.

According to the finalists' cost estimates, Bally's would be eligible for a 15-year licensing, while Metropolitan Park and Resorts World would be eligible for a 20-year concession. Wynn's Hudson Yards bid and Soloviev Group's Freedom Plaza are the only two plans from downstate that would have gone over the $10 billion mark to get a 30-year licence, but neither is a finalist.

People are now paying more attention to New York's gambling regulators.

The five-member GFLB is now the most important group in the New York gaming world. None of the five people who were chosen know anything about gaming or have worked in it before. This was done on purpose to make sure they were neutral. This summer, Board Chair Vicki Been went even further and told Bloomberg that casinos are "nowhere I want to spend my time."

This year, four of the five members were chosen to be on the board. Cindy Estrada was the most recent person to be hired. She started on September 30, the same day as the CAC deadline. Only Been has been in office for more than a year, when he was appointed in 2022.

This month, there have been two GFLB meetings. The first was on October 8 and the second was on October 15. The meeting on October 8 lasted only 15 minutes and was mostly about planning. There is no archived audio or video from the meeting on October 15, which was supposed to last three hours.