Iris Capital to Purchase Casino Canberra from Aquis for A$63M

It was revealed on Monday by Aquis Entertainment Ltd. that a new agreement had been struck with Iris Capital of NSW to sell all of the shares in the casino Canberra for AU$63 million (US$42.4 million). The agreed upon price was roughly $3 million more than Iris' initial offer and roughly $5 million more than the Oscar Group subsidiary had proposed last month.

The agreement is still subject to regulatory approval and official shareholder approval, therefore it is not yet final. In addition, Aquis left the door open to a higher offer and agreed to pay Iris a $1 million break fee in the event that Iris decided not to exercise the first right of refusal. This means that regardless of the amount that may be offered for the property, Iris can match or beat that price and still complete the sale.

With the exception of pandemic precautions, the casino has continued to operate since it opened in Australia's capital city in 1994 with a 99-year license, but in recent years, its future has been in turmoil and then limbo.

It was obvious to choose Forever License (with a gamble)

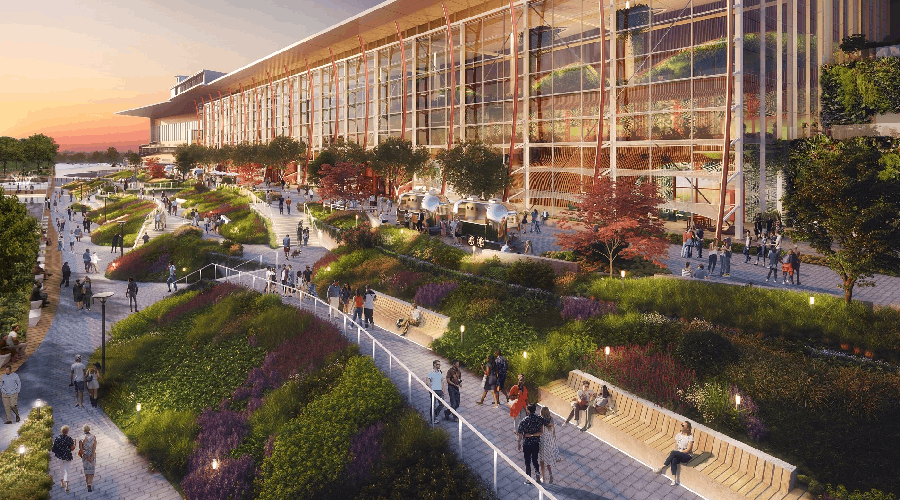

Aquis bought the property in 2014 with plans to spend AU$330 million (226 million US) on extensive renovations and expansion. The extension, nevertheless, was conditional on the ACT government approving the operator's installation of up to 500 slot machines, which would assist pay for capital expenditures and provide income for the operators.

It wasn't until 2018 that the offer was turned down by the government due to worries about a shifting regulatory landscape and the specifics of the funding. The ACT government responded with what it deemed to be a workable compromise, authorizing 200 slot machines and 60 additional electronic gaming machines, when it officially addressed the issue. Aquis immediately turned down the offer.

The primary business venture of Aquis is Casino Canberra. The company made a high-stakes bet that it would be able to gain slots gaming licences sufficient to cover its exposure in purchasing, enhancing, and maintaining the facility. During that time, a number of other exceptionally high-value projects were in the pipeline, including Crown's Barangaroo casino.

The Aquis board is examining new business options in light of an injection of funds and plans to disclose any roadmaps produced for shareholders this month along with the notice of shareholder meeting and vote in July with action scheduled for August.

hunched over by a "Push"

The board of directors of Aquis stated, "The board of Aquis is reviewing the best use of the sale proceeds, including evaluating alternative business options, debt repayment, and potential distribution of funds to shareholders.

"Aquis is also considering utilizing the proceeds from the Transaction to repay some or all of the convertible loan between the Company and its significant shareholder Aquis Canberra Holdings Pty Ltd and the possibility of a shareholder dividend or distribution," the statement continued.

According to Allison Gallaugher, the CEO of Casino Canberra and Aquis, "The amended Transaction delivers a significant value uplift to the Company and its shareholders and reflects the sustained outstanding operating performance and prospects of the business. I am very eager to collaborate with Iris on improving our company going forward.

"We are pleased about the opportunity to buy Casino Canberra and look forward to working closely with the Aquis team in the future," said Sam Arnaout, the sole director of Iris.